Decoding Europe's energy crisis

Energy demand reduction, solar and wind energy have so far shielded Europe from the very worst of the energy crisis. But European countries are still scouring the planet for expensive fossil fuels, when it’s clear that investing in renewable energy solutions and energy savings is what will bring permanent reductions to people’s bills, and help deliver the peace, energy security and safer climate we all want. No wonder 87% of Europeans think “the EU should invest massively in renewable energies”.

Europe’s energy crisis is a fossil fuel crisis

There is no doubt: Europe’s energy crisis is a fossil fuel crisis at heart. The economic fallout of the COVID-19 lockdowns, Russia’s full-scale invasion of Ukraine and the effects of climate change have sent energy prices skyrocketing, leaving European consumers with massive bills as a consequence of spiralling prices across all energy markets. Reliance on these volatile, damaging fuels, and the regimes that supply them have created this mess. The fastest, fairest, and most secure way out is investing heavily in energy savings and power sources that do not require fuel.

Read more

Solar and wind to the rescue

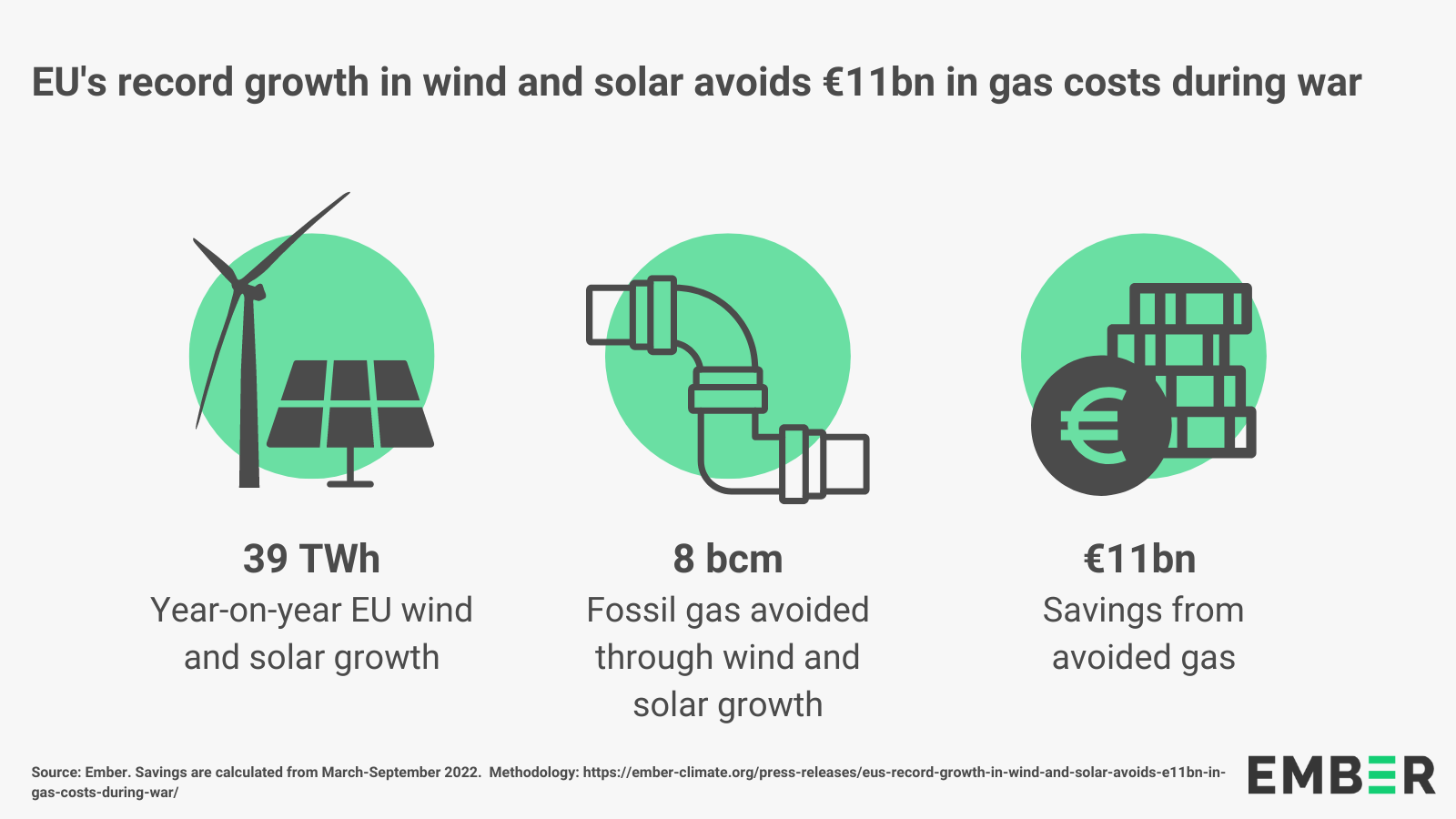

Until recently, the EU imported approximately 40 percent of its fossil gas from Russia, as well as significant amounts of coal and oil. These numbers have now collapsed, as European countries rightly push to end purchases of Russian fossil fuels that help fund Russia’s invasion of Ukraine. This, combined with a steep decline in power generation from hydro due to drought, and nuclear due to technical issues, has left European countries looking high and low for new sources of energy. Thankfully, we don’t need to search beyond our own borders: solar and wind energy leapt by 58 TWh between January and August 2022 compared to the same period in 2021, compensating for the drop-off in other sources. But had Europe been more ambitious, not remained cosy with fossil energy companies, and doubled down on solar and wind, there could have been no need for the 60 TWh of power generated by coal and fossil gas over the same period, and Europeans would not be facing unaffordable bills.

We can’t keep making the same mistakes

Sadly, rather than learning from these mistakes and urgently investing in cheap renewable energy solutions that would match affordable energy supplies with demand, many European governments are engaged in a scramble for ever-more expensive fossil fuels. These often come from far-flung places of similarly authoritarian tendencies to Russia and are rightly being phased out in Europe because of their environmental impacts (coal), or have previously been overlooked (LPG) because they are so expensive

More fossil fuels equals higher bills and greater vulnerability

Renewables have been economically competitive for many years. There is no economic (or any other) justification for new investments in fossil fuel infrastructure, such as LNG terminals which would lock consumers into unnecessarily expensive sources of energy with vulnerable supply chains that will inevitably become stranded assets.

Those that caused the crisis are profiting from it

Similarly, throwing billions of euros of public money onto a bonfire of oil and fossil gas subsidies is not only unsustainable, but actively takes money that should be spent on long term renewable and efficiency solutions, and hands it to fossil fuel companies already making massive windfall profits.

Renewable solutions are THE route out of the energy crisis

Past failures to properly invest in renewable energy solutions, combined with emergency measures based upon extortionate fossil fuels have left Europeans facing stark choices, such as between heating and eating. While some emergency fossil fuel measures are necessary to ensure that there is enough heating and power this winter, this is not a viable long term strategy, either from an economic or climate perspective. Rapidly building new renewable energy infrastructure, increasing energy efficiency, and making energy savings remains the only short and long term strategy for escaping the energy crisis.

Read more

Solar and wind to the rescue

Until recently, the EU imported approximately 40 percent of its fossil gas from Russia, as well as significant amounts of coal and oil. These numbers have now collapsed, as European countries rightly push to end purchases of Russian fossil fuels that help fund Russia’s invasion of Ukraine. This, combined with a steep decline in power generation from hydro due to drought, and nuclear due to technical issues, has left European countries looking high and low for new sources of energy. Thankfully, we don’t need to search beyond our own borders: solar and wind energy leapt by 58 TWh between January and August 2022 compared to the same period in 2021, compensating for the drop-off in other sources. But had Europe been more ambitious, not remained cosy with fossil energy companies, and doubled down on solar and wind, there could have been no need for the 60 TWh of power generated by coal and fossil gas over the same period, and Europeans would not be facing unaffordable bills.

We can’t keep making the same mistakes

Sadly, rather than learning from these mistakes and urgently investing in cheap renewable energy solutions that would match affordable energy supplies with demand, many European governments are engaged in a scramble for ever-more expensive fossil fuels. These often come from far-flung places of similarly authoritarian tendencies to Russia and are rightly being phased out in Europe because of their environmental impacts (coal), or have previously been overlooked (LPG) because they are so expensive.

More fossil fuels equals higher bills and greater vulnerability

Renewables have been economically competitive for many years. There is no economic (or any other) justification for new investments in fossil fuel infrastructure, such as LNG terminals which would lock consumers into unnecessarily expensive sources of energy with vulnerable supply chains that will inevitably become stranded assets.

Those that caused the crisis are profiting from it

Similarly, throwing billions of euros of public money onto a bonfire of oil and fossil gas subsidies is not only unsustainable, but actively takes money that should be spent on long term renewable and efficiency solutions, and hands it to fossil fuel companies already making massive windfall profits.

Renewable solutions are THE route out of the energy crisis

Past failures to properly invest in renewable energy solutions, combined with emergency measures based upon extortionate fossil fuels have left Europeans facing stark choices, such as between heating and eating. While some emergency fossil fuel measures are necessary to ensure that there is enough heating and power this winter, this is not a viable long term strategy, either from an economic or climate perspective. Rapidly building new renewable energy infrastructure, increasing energy efficiency, and making energy savings remains the only short and long term strategy for escaping the energy crisis.

Temporary emergency coal measures announced since Russia’s full-scale invasion of Ukraine

At the end of 2020, Pljevlja power plant had exhausted its 20,000 operating hours quota for the 2018-2023 period as established in the European Union’s Large Combustion Plants Directive. The plant was still operating illegally until the Montenegrin government amended its IED law in 2022.

The Romanian government prolonged operations of two coal plant units, Rovinari 3 and Turceni 7, from the end of 2022 to October 2023. The two units have 660 MW in capacity.

To implement a deal made between state and federal government and energy company RWE, the German parliament passed a law to shut down 3 lignite plants (3GW) in 2030 instead of 2038 and extend the operations of two plants (1.2 GW) from 2022 to 2024. This expedites the lignite exit in NRW from 2038 to 2030.

Spanish utility Endesa has reactivated unit 1 of its AS Pontes coal plant and plans to refire unit 2 at the beginning of 2023, at the request of Spain’s ministry for the ecological transition.

Poland’s minister for state assets says the country will slow the phase out of its coal mines, but that the government’s end date for all coal mining in Poland remains 2049.

France’s government removes cap that limited its 1260MW Cordemais coal plant from operating more than 700 hours per year.

The Danish government orders Ørsted to continue operating its 407 MW Esbjerg 3 coal unit, which had been scheduled to close in March 2023, and to resume operations at its 380 MW Studstrup 4 coal unit, which closed in 2016. Both are now due to operate until June 2024.

The Finance Committee of Odense, Denmark is extending operations of the Fjernvarme Fyn power plant from its originally scheduled end in December 2022 until spring 2024. The Odense government still maintains their 2030 climate neutrality goal.”

All four units of Uniper’s 543 MW Ratcliffe coal plant will continue to operate beyond September 2022 until the UK’s 2024 coal exit deadline.

The Hungarian government has published an emergency decree, which says that the country will increase the domestic production of lignite, the timeline and scope of which is unclear, and restore to production all units at the country’s Matra coal plant and ensure that production continues. This constitutes a structural development of coal, as restoring the units will require significant investment, while more workers will be required for this and to increase lignite production. Should Matra be restored, it will breach the LCP BREF through the operation of Block II.

Finnish utility Fortum is preparing its Meri-Pori coal power plant to re-enter service.

The Italian government has issued a regulation authorising non-gas power plants (i.e. coal-fired power plants among others) to operate at higher capacity until March 2023. Italy has a 2025 coal phase out.

Germany passes a package of energy laws that include provisions to allow for the reactivation or extended lifespans of coal-fired power, the goal of a renewables-based power sector by 2030, and a commitment to phase out coal by 2030.

Drax has agreed to the Uk government’s request to keep its two 700 MW coal-fired units at its Drax power station running until March 2023. Both were due to close by September 2022, but remain under the UK’s 2024 coal exit plan.

Czech state-owned mining company OKD will continue mining hard coal in the north-east of the country until at least the end of 2023 – with the possibility to extend to 2025 – scrapping earlier plans to halt mining in 2022. Coal operator CEZ extends the lifespan of its Detmarovice coal plant (600 MW), which sources its coal from OKD. Detmarovice had been scheduled to retire in the spring of 2023.

The French government says it is “keeping open the possibility” of refiring its 647 MW Emile Huchet coal plant this winter.

The operator of the Italy’s national grid has asked Italian utility A2A to prepare its 336 MW Monfalcone coal plant for operation, citing Shortfalls in supplies of Russian gas and a 60% fall in hydroelectric power production from the company’s plants in Friuli and Venezia Giulia due to extensive drought in the region.

Poland’s Prime Minister Mateusz Morawiecki has announced that the country will boost coal production before the winter heating season by about 1.5 m tonnes. Poland produced 19 m tonnes of coal in the first four months of 2022, about 155,000 tonnes more than at the same time last year.

Portugal’s Ministry for Environment has reiterated that the country has no intention of going back to coal after closing its last coal plant in 2021.

The Dutch government has lifted a cap which restricted coal-fired power plants to operate at 35% of their maximum output. It is a disappointing step for the climate and people’s health, and could have been avoided by rolling out more renewable energy capacity sooner.

Austria’s government orders the operator of the country’s 246MW Mellach coal plant to prepare it for operation, amidst questions over who will staff the plant, where the coal to burn at the plant will be procured from, and the legal basis for reversing the country’s 2020 coal phase out.

EDF has agreed to the UK government’s April 2022 request to keep its West Burton A coal power plant operating through the upcoming winter. Of the plant’s four 547MW units, EDF will make two available, postponing their closure to April 2023. All four units had been scheduled to close by September 2022, but remain under the UK’s 2024 coal exit plan.

The Polish government has approved measures to subsidise coal for households and housing cooperatives.

VW prolongs coal-burning at its 306MW Wolfsburg coal power plant.

The Greek government has announced that all of the country’s three existing coal plants can theoretically operate until 2025. The last of these plants had been due to close in 2023. The country’s Ptolemaida 5 coal plant, which is expected to be commissioned in early 2023, could operate until 2028 according to the Greek climate law and the country’s NECP. The plant had been scheduled to be converted to burn fossil gas in 2025.

Portugal aims to increase the share of renewables in its electricity production to 80% by 2026, four years earlier than previously planned. The target represents a significant acceleration in the decarbonisation of Portugal’s economy, with its share of renewables in electricity only increasing by 17% over the previous 12 years.

How much does each EU member state spend per year?

This is what each EU country has spent on Russian coal, oil, and fossil gas in recent years, according to UN Comtrade trade data (2019) data is shown when 2021 is not yet available. (Data for 2020 is not representative due to the impact of COVID-19).

Fossil gas imports are apportioned to countries using Eurostat energy trade data.

(N/A means no meaningful imports, or no data).

Check out our Russian Fossil Fuels tracker here.

Austria

![]()

Total spent on Russian fossil fuels: €2093m (data for 2019)

Belgium

![]()

Total spent on Russian fossil fuels: €2417m (data for 2021)

Bulgaria

![]()

Total spent on Russian fossil fuels: €2784m (data for 2019)

Croatia

![]()

Total spent on Russian fossil fuels: €581m (data for 2021)

REPUBLIC OF CYPRUS

![]()

Total spent on Russian fossil fuels: €2093m (data for 2021)

CZECH REPUBLIC

![]()

Total spent on Russian fossil fuels: €2093m (data for 2021)

DENMARK

Total spent on Russian fossil fuels: €796m (data for 2021)

ESTONIA

Total spent on Russian fossil fuels: €680m (data for 2021)

FINLAND

Total spent on Russian fossil fuels: €3735m (data for 2021)

FRANCE

Total spent on Russian fossil fuels: €8173m (data for 2019)

GERMANY

Total spent on Russian fossil fuels: €24116m (data for 2019)

GREECE

Total spent on Russian fossil fuels: €3636m (data for 2019)

HUNGARY

Total spent on Russian fossil fuels: €3646m (data for 2021)

IRELAND

Total spent on Russian fossil fuels: €252m (data for 2019)

ITALY

Total spent on Russian fossil fuels: €14304m (data for 2021)

LATVIA

Total spent on Russian fossil fuels: €519m (data for 2021)

LITHUANIA

Total spent on Russian fossil fuels: €3173m (data for 2021)

LUXEMBOURG

Total spent on Russian fossil fuels: €3m (data for 2021)

MALTA

Total spent on Russian fossil fuels: €280m (data for 2019)

NETHERLANDS

Total spent on Russian fossil fuels: €13489m (data for 2021)

POLAND

Total spent on Russian fossil fuels: €9238m (data for 2021)

PORTUGAL

Total spent on Russian fossil fuels: €629m (data for 2021)

ROMANIA

Total spent on Russian fossil fuels: €2502m (data for 2019)

SLOVAKIA

Total spent on Russian fossil fuels: €5140m (data for 2021)

SLOVENIA

Total spent on Russian fossil fuels: €271m (data for 2021)

SPAIN

Total spent on Russian fossil fuels: €5085m (data for 2021)

SWEDEN

Total spent on Russian fossil fuels: €1125m (data for 2021)