Eight financial institutions have handed Europe’s most polluting utilities almost €16 billion in support since the Paris Agreement was signed in December 2015, a new briefing by Europe Beyond Coal and its partners BankTrack, Foundation Development YES – Open-Pit Mines NO, Friends of the Earth France, IIDMA, Re:Common and Urgewald has found.

NEW briefing ‘Fools Gold’ »

Coal Finance and Utilities

The twilight of the coal industry is upon us, and the twin crises of air pollution and climate change call for ambitious closure plans of coal power plants and mines across Europe. The year 2030 clearly marks the point when Europe must and will have moved beyond coal, and a growing number of financial institutions are taking this responsibility seriously. These institutions can be instrumental in redirecting the financial flows away from coal, protecting not only themselves from an increasingly risky investment, but also people’s health and our shared climate.

This is already happening. Every two weeks a bank, insurer or lender announces new coal restrictions, and vanishing appetite from financial institutions, unfavourable market conditions, and increasing government coal phase-out announcements show that what lies ahead is a slow elimination of the coal industry in Europe.

Financial institutions must now pick up the pace: they are duty-bound to take a leading role in pushing coal out from utilities’ energy mix by 2030 the latest, and must quickly adopt biting coal policies or tighten those already in place.

It is in the best interest of the financial institutions to act – and their fiduciary responsibility. The failure to consider coal in investment strategies can undermine both the projected financial returns but also financial institutions’ social license to operate.

Utilities must close – not sell – their coal plants by 2030 at the latest

Utilities need to urgently align their business models with the Paris Agreement. This means publicly adopting a decarbonisation target, including a clear plan for the gradual closure of coal plants and mines, by 2030 at the latest in the OECD and Europe, and in 2040 in the rest of the world.

Utilities have a responsibility shut coal plants, not sell them. Selling only passes the buck, allowing damage to human health and the climate to continue. Utilities that have profited off coal already bear significant responsibility for the damage their business has caused.

Utilities in focus

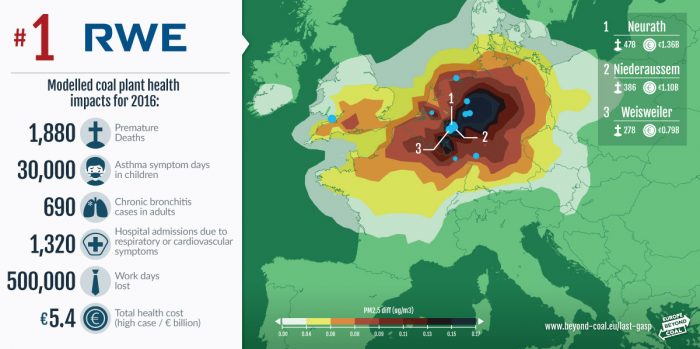

In Europe, the CO2 emissions of companies are concentrated: a handful of utilities account for approximately half of all coal-related emissions in Europe. These companies and their coal plants must be the front and center of attention in order to slash Europe’s emissions.

Financial Institutions must become stewards – or cease to support utilities

Financial institutions have the power to facilitate the necessary change needed in our energy systems. The smart money has already abandoned fossil fuel investments and a critical mass of financial institutions have introduced coal policies. Those that continue to financially support coal companies that do not have robust phase out plans are not only gambling with their money, they are also risking their reputations. Coal plants and mines have already become stranded assets and nobody wants to be the last financier standing.

Financial institutions also need to urgently align their business models with the Paris Agreement. Just as utilities have a responsibility to phase out coal by 2030 at the latest in the OECD and Europe (and 2040 globally), financial institutions have a duty to encourage this process by eliminating coal assets from their business lines. This means either actively engaging with the coal companies they are involved with on this topic, or divesting from them.

European Financial Institutions’ ties to coal

Despite its image as a climate leader, BNP Paribas is blocking the transition out of coal through its financing of coal companies. Among its clients are the Czech utility CEZ and German lignite giant RWE. Both companies are expanding their coal mines, do not have a phase out plans for their existing coal assets but are looking at maximizing the life of their plants. BNP Paribas ranks among the top Western financiers of the coal industry in Europe and internationally, including having provided 174 and 133 million euros of financing to CEZ and RWE between 2016 and 2018. Furthermore, at the beginning of 2019, BNP Paribas renewed its contributions to a 5 billion euro credit line for RWE. BNP Paribas insurance and asset management branches have recently adopted a no-coal policies resulting in the exclusion of both RWE and CEZ. It’s time for BNP Paribas to also exclude them from its financing.

The German group Talanx is the top underwriter of the Polish coal industry through its subsidiaries TuIR Warta and Hannover Re. Following pressure from Europe Beyond Coal and Unfriend Coal, both announced in April 2019 that they will “in principle” no longer underwrite new coal-fired power plants and coal mines. However, far from being a strict commitment, Talanx said a limited number of exceptions could be allowed “in countries where coal accounts for a particularly large share of the energy mix and access to alternative energy sources is insufficient.” What the policy means for Poland and Talanx’s intentions to remain the last major insurer underwriting new coal there are open questions.

Société Générale is one of the top 10 financial institutions supporting the largest coal power companies in Europe. It is either an investor or creditor for all key coal utilities, including the two Czech utilities EPH and CEZ, and the German lignite giant RWE. According to research, Société Générale provided 397 million, 75 million and 133 million euros of financing to EPH, CEZ, and RWE respectively, between 2016 and 2018. At the end of 2018, it also held 88 million euros worth of shares and bonds in RWE.

EPH and CEZ are expanding in the coal sector and none of the three have phase out plans for their existing coal assets that align with climate science. Instead, some of them actively seek to maximise the operational life of their plants and push back their retirement. EPH is a major threat to the transition out of coal in Europe: their business model is based on purchasing unwanted coal assets and running them as long as possible. Société Générale made new announcements on coal in May 2019, that remain well below best practices and vague on the fate of these dodgy companies. The revision and implementation of its policy needs to exclude these key coal utilities from all support.